There are several steps to be taken in order to complete a purchase of a foreclosed properties in pag-Ibig. We have itemized the most basic requirements here to serve as a guide for those that are aspiring to have their very own house and lot.

Pag-IBIG foreclosed properties are often available at lower prices compared to the market value for several reasons.

1.Loan default and foreclosure

Pag-IBIG Fund provides housing loans to its members, and in cases where borrowers fail to meet their loan obligations, the properties are foreclosed. These foreclosed properties are then sold by Pag-IBIG to recover the unpaid loan amount. Since the main goal is to recoup the outstanding debt, these properties are often priced below their market value to attract buyers quickly.

2.Bulk acquisition

Pag-IBIG occasionally acquires properties in bulk through foreclosure proceedings. These properties may include houses and lots from different borrowers, locations, and conditions. To sell these properties efficiently, Pag-IBIG sets competitive prices to encourage interested buyers to purchase them in their existing condition.

3. Limited marketing and maintenance

Foreclosed properties may not receive the same level of marketing and maintenance as properties in the traditional real estate market. Pag-IBIG primarily focuses on recovering the outstanding loans and may not invest in extensive marketing campaigns or repairs for the foreclosed properties. This can contribute to lower prices as buyers may need to invest in repairs or renovations.

4. Quick sale requirement

Foreclosed properties are generally sold on an “as-is, where-is” basis, meaning that buyers purchase the property in its current condition without any guarantees or warranties. Pag-IBIG aims to sell these properties quickly to minimize holding costs and administrative efforts, which can lead to lower prices.

So here are the basic steps needed to acquire a property in Pag-Ibig.

To buy a house in Pag-IBIG foreclosed properties, you can follow these general steps:

1. Research and identify available properties

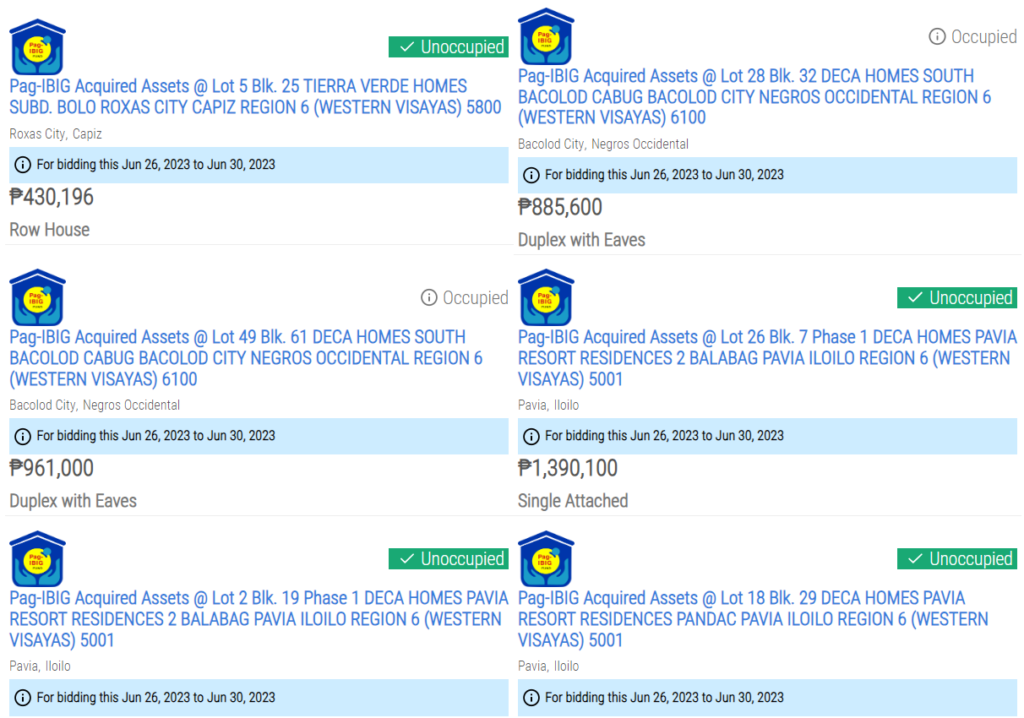

Visit the official website of Pag-IBIG Fund (www.pagibigfund.gov.ph) and look for the section on foreclosed properties. Browse through the list of properties to find the ones that meet your requirements in terms of location, size, and price. We have a website dedicated to the easier finding of this properties. You can check foreclosedproperties.info, acquiredassets.ph and pagibig.info, all of which the main content are the property listings from pag-ibig.

Example of Foreclosed Properties found in Pagibig.Info

2. Attend property auctions

Pag-IBIG conducts public auctions where foreclosed properties are sold to the highest bidder. Check the auction schedule on the website or contact the nearest Pag-IBIG branch to get information about upcoming auctions. Attend the auction to participate in the bidding process.

3. Secure financing

Before participating in the auction, ensure that you have the necessary financing in place. You may choose to pay in cash or apply for a loan from Pag-IBIG or other financial institutions. Determine the loan amount you can afford and ensure you meet the eligibility requirements.

4. Conduct due diligence

Prior to bidding, conduct a thorough inspection of the properties you are interested in. Assess the condition of the house, check for any liens or encumbrances, and verify the property’s market value. This step is crucial to avoid any surprises or issues later on.

5. Participate in the auction

On the auction day, arrive early and register as a bidder. Pay attention to the auction proceedings and submit your bid for the property you want. Be prepared to compete with other bidders, and remember to stick to your budget.

6. Secure the winning bid

If your bid is successful, you will be declared the winning bidder. Pay the required down payment immediately, usually around 10% of the bid price. You will also need to sign the necessary documents, including the Deed of Conditional Sale and other legal paperwork.

7. Settle the payment

Within a specified period (usually 30 days), settle the remaining balance of the purchase price. You can choose to pay in cash or secure financing through a Pag-IBIG loan or other financing options. Ensure that you fulfill all the payment obligations within the agreed timeframe.

8. Transfer of ownership

Once you have completed the payment, Pag-IBIG will facilitate the transfer of ownership to your name. Work with the agency to process the necessary documents and fees involved in transferring the property.

Conclusion

Remember that the foreclosed properties in pag-ibig are cheap but there are several con’s into this which we will discuss more in detail with our next blog topics. It is best advise to visit the property that you are willing to bid into and make sure that there are no occupants or tenants on the listed property. Otherwise you will have a hard time asking those people to vacate the property. Some go to length process such as court filing.

References:

Paano Mag Bid ng Property sa Acquired Assets ng Pag-ibig